Thursday, September 20, 2018

How to trade Triangle

Usually,

pattern Triangle forming during market consolidation inside a trend and

can either indicate the end of the trend or that the trend will

continue.

So, you might already know that there are 3 types of triangle in Forex - descending, ascending and symmetrical, I trade all of them the same way, I always place 2 orders - Stop Buy and Stop Sell.

That is all for now, if you have any questions, please leave comments I'll try to respond ASAP.

So, you might already know that there are 3 types of triangle in Forex - descending, ascending and symmetrical, I trade all of them the same way, I always place 2 orders - Stop Buy and Stop Sell.

You

can use triangle system on almost all popular pairs. I usually use

EUR/USD, but if I see a triangle forming on any other pair I would trade

it too.

You

can look for triangles on any chart but usually I trade minimum 15M

chart and maximum 1H chart, triangles are usually more visible on bigger

charts.

Here are the System Rules:

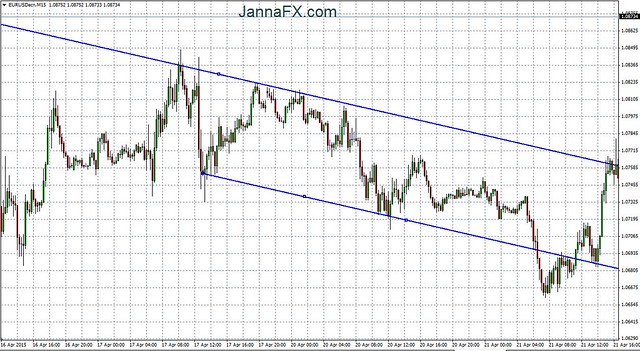

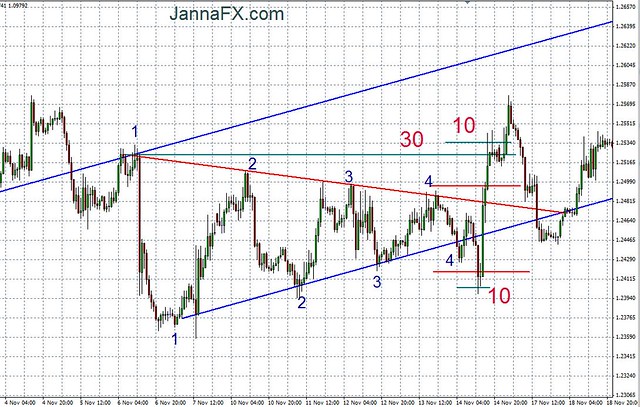

1. Identify main trend.

Example here is - downtrend.

2. Wait for market forming 2 tops and 1 bottom or 2 bottoms and 1 top, draw the trend lines.

Example

here, bottom 1 inside the trend touches the trend line; top 1 did not

reach opposite trend line, bottom 2 formed, so I draw the trend line

through the bottoms 1 and 2 and I draw another parallel line through the

top 1.

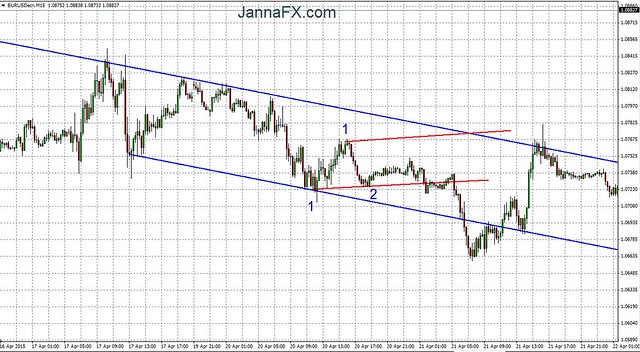

3. Wait for the next top or bottom, draw another trend line. Identify, if the pattern looks like a triangle.

Example here, top 2 formed, so I draw another trend line; it looks like a triangle now.

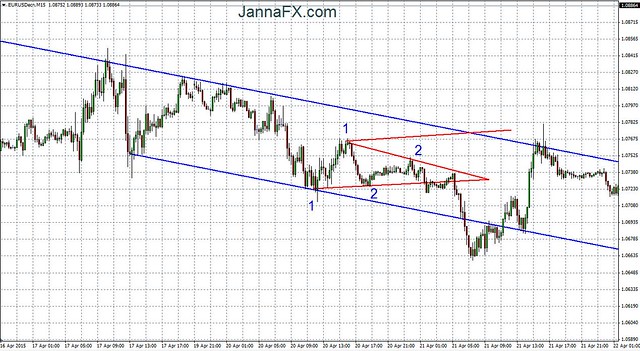

4.

There are always should be 2 tops and 2 bottoms touching triangle

borders. Next, wait for formation of top or bottom number 3. After that,

usually, market would start to brake through triangle lines. If not it

would start braking through during formation of 4th top/bottom. These

are in my opinion the strongest triangles compare to those which will

start to create 5th or 6th top/bottom

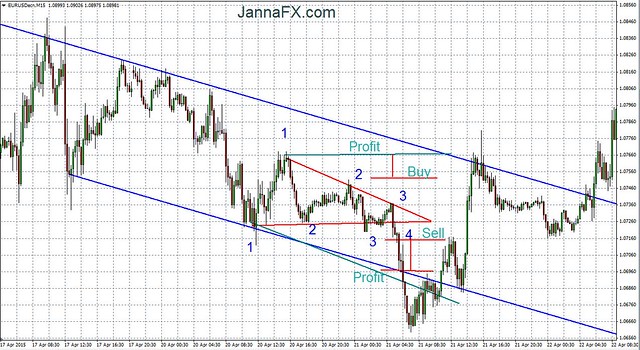

5. Placing the orders:

depends on situation there could be different rules, but usually, I

would place Buy stop/ Sell stop 10 pips higher/lower previous top/bottom

if the next top/bottom expected to brake. Profit target would be

parallel lines of triangle borders, or around main trend lines; usually,

I take some profit around 10-20 pips and either move stop loss until

market reaches the target or use trailing stop. Stop losses I place at

the opposite prices of buy/sell orders (for example - Buy order would be

also stop loss for Sell order and the other way around).

Example

here - I was waiting for formation of bottom 3, but because bottom 1-2

were around the same level I could already place the order Sell stop

from the bottom line of the triangle. After bottom 3 was created and

market moved a bit up I placed the order Buy stop, it would have been 10

pips above top 2, but here is difference, because the triangle is so

small I had no room so I placed the order 10 pips above little channel

which formed slightly below top 2.

Important moments:

1. Careful during major News events:

а. market can start braking around top/bottom 2, in this case I would not continue with triangle system;

б. market can move one direction take us in trade and than change direction without reaching the target.

So,

usually if in trade before the news, better to close some positions and

move stop in safe place, and try to do the same after news event if you

did not open a position before it; if in doubt avoid trading.

Example

here - perfect triangle during news event, market moved down, I closed

some positions and then strong movement up I closed again some

positions, it did not reach the top blue line (my target), so I closed

the rest positions around green line - resistant level of triangle from

top 1.

2.

Market can move outside triangle around it very top where two lines

crossing each other and move slowly forming a channel, this usually can

happen on 15M chart and during Asian session, or at the closing of the

week or at the opening of a new trading week. If that is happening I try

to correct lines and see if there is still triangle, if not, I would

cancel the system.

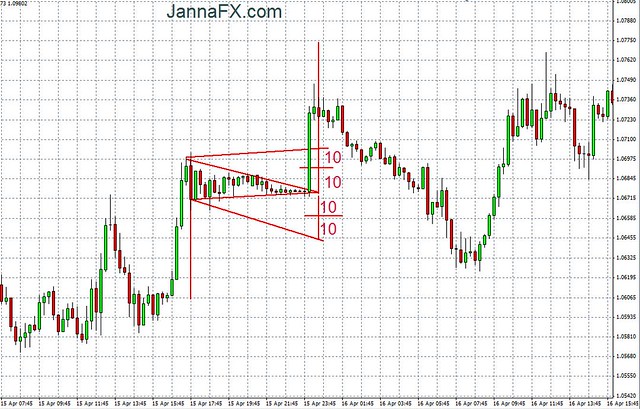

3.

Pennant is also a triangle, which I trade mostly the same way, except

usually pennants are very small and there are no strong tops and bottoms

in them, so I would look for a channel inside the pennant and place the

orders as usual. Also pennant similar to a flag, so usually it forms

after very strong and sharp movement, so the profit target could be the

length of that previous movement.

Usually pennant is a strong signal for trend to continue, like on the example below,

but

never be sure 100% in anything in Forex, after pennant, market can also

turn around, like in the example below, this is why I mostly all the

time place 2 orders.

Some other examples of triangles:

Subscribe to:

Comments (Atom)